Responsible for participating in and supervising multiple client engagements and other related activities under the general direction of a Team Manager. Discusses moderately complex issues with engagement team and client management.

Responsibilities & Duties

- Technical

- Implement departmental annual programme

- Prepare tax computations for clients and completes provisional / Final income tax returns ready for submission to the TRA

- Advise client on Tax Liabilities and reminds them on due date for payments of taxes

- Attends to tax queries arising from examination of clients’ tax returns and amounts submitted to the TRA and ensure that prompt replies to the TRA queries are prepared expeditiously.

- Assist all Tax clients with registration procedures with TRA Departments (Income Tax and VAT) up to the point where necessary registration Certificates are obtained

- Carry out VAT Compliance and refund claims verification and follows up VAT repayment claims

- Carry out Tax Compliance checks on the Payroll Taxes (PAYE, NSSF, SDL) with appropriate advice to clients

- Carry out Tax Compliance checks on Withholding Taxes under the Income Tax Acts and ensures that Stamp Duty and other Levies are complied with and prepares advise for client accordingly.

- Review clients’ assessments and recommendation whether objections or appeals, where appropriate, are called for.

- Prepare and reviews Memorandum and Statement of Facts for Tax appeals as appropriate to the Tax Appeals Board / Tax Appeals Tribunal.

- Participate in the firm’s training programme for Department’s junior members of staff.

- Attends all other duties whether of Taxation nature or otherwise as may be assigned from time to time by your senior.

- Market leadership and Growth

- Meets with senior client personnel to discuss aspects of an engagement.

- Effectively explains to clients and colleagues the objectives, critical success factors, and key performance indicators for projects and clients.

- Delivers excellent client service and seeks out and communicates opportunities to improve the EY / Client relationship.

- Identifies and reports to manager/ Partner potential cross selling opportunities to extend client services to existing clients. Uses available tools to help with this as required.

- Ensures client staff understands our requirements listing and spends time explaining this as needs be.

- Encourages team to perform all possible engagement work at the client site.

- People

- Demonstrates commitment to support management and encourage new employees.

- Participates constructively in developing the team environment.

- Makes time to discuss work and performance with less-experienced members

- Encourages individuals to think for themselves.

- Coaches others to resolve single issues effectively on a one-to-one basis.

- Provides creative solutions to issues.

- Ensures work of others has been reviewed by the person who delegated the task.

- Regularly liaises with manager to ensure all issues and expectations are known by all team members in a timely fashion.

- Encourages team members to utilise the differing strengths of the team.

- Recognises other team members’ work/life requirements

- Coaches others to bridge skill deficiencies.

- Provides feedback on a timely basis to more junior members of the team.

- Applies constructive feedback to the benefit of own personal development.

- Consistently goes out of their way to be helpful to others

- Operational Excellence

- Facilitates discussions of other team members regarding the overall Tax strategy.

- Continually provides feedback to the team on progress.

- Tracks team progress against milestones and agreed upon deliverables and knows at all times the progress made against the work plan. Takes corrective actions necessary to ensure progress is on track.

- Clearly identifies who is best suited and has the capacity to undertake a delegated task.

- Effectively delegates tasks to team member and communicates expectations.

- Monitors, coaches and encourages those to whom work is delegated.

- Credibly discusses engagement issues with colleagues (and clients as appropriate).

- Understands budget and target responsibilities and meets those expectations.

- Provides enough guidance to ensure staff are well prepared and understand client’s needs and expectations.

- Acknowledges limit of team’s own knowledge and brings in expert resources from other areas of the firm.

- Able to make timely decisions on tax queries arising

- Anticipates issues and problems, is able to determine likely significance and deals with these as matters of importance.

- Has knowledge of all issues arising on the engagement and briefs Senior Manager/ Manager accordingly.

- Proactive in approach to staff bookings, client liaison and arranging manager and partner time necessary for the engagement.

- Consistently produces deliverables in time for deadlines for the engagement, whether overseas reporting and their deadlines, internal or client requests.

- Ensures wrap up and archiving of engagement is performed in a timely and efficient manner (in conjunction with manager).

- Ensures issues arising are followed through to a conclusion (in conjunction with manager).

- Prioritises work to be done and focuses on the most important tasks first.

- Makes constructive response to differing viewpoints of the team.

- Recognises when to seek help with problems or workload and asks for it.

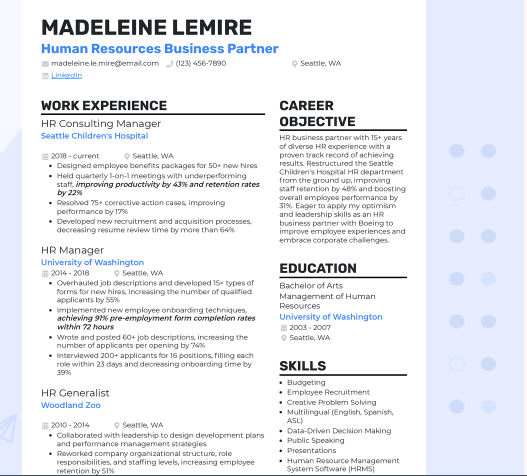

Academic Qualifications

- Graduates from Finance / Economics / Accounting/ Taxation/ Law/ Agro economics etc.

- 4-6 years of experience in taxation fields;

- Excellent written and verbal communication skills in English (other language is a plus);

- Proficient IT skills (Word, Excel, Power Point);

- CPA/ ACCA is required

Work Experiences & Skills

- Self-motivated, positive attitude

- Willingness to learn

- Attention to detail with a commitment to high quality and accuracy

- Desire to exceed expectations

- Interest in the different fields of Taxation

- User level IT (Ms Office) knowledge

Submission deadline

Please submit your application pack electronically in pdf format before 06th August 2024. Your application letter, CV, ID’s, certificates etc, should be merged in one document for quick upload.

Who we are:

At EY, we support you in achieving your unique potential both personally and professionally. We give you stretching and rewarding experiences that keep you motivated, working in an atmosphere of integrity and teaming with some of the world’s most successful companies. And while we encourage you to take personal responsibility for your career, we support you in your professional development in every way we can. You enjoy the flexibility to devote time to what matters to you, in your business and personal lives. At EY you can be who you are and express your point of view, energy and enthusiasm, wherever you are in the world. It’s how you make a difference. “No matter when you join, how long you stay, the EY experience lasts a lifetime!”

Also read;

Leave a Reply

View Comments